The importer must describe the goods in details including the package type value quantity weight and where the items come from and the. Below are the documents which you need to prepare as a importer -.

Documents Required For Import Export Customs Clearance Drip Capital

Some goods are exempt from duties such as electronic products like laptops and electric guitars.

. Leaflet catalogue or other related documents. Your Shipment Will Be Assessed For Applicable Tax And Duties. Customs Prohibition on Import Order 2008 Second Schedule.

Customs No6 Transhipment 4. Customs Form No 8. Conditional Prohibition except With Procedure.

Procedures and Documentary Requirements. The information provided here details on how to import goods to Malaysia especially import customs clearance procedures in Malaysia. Customs No4 Inward Manifest JKED No4 2.

Customs Form No 1 K1 Declaration of goods imported. Take last port clearance Zarpe and the Jabatan Laut document. Processing The Bill Of Entry.

Customs No5 Outward Manifest 3. Clearance documents required are. Live animals-primates including ape monkey lemur galago potto and others.

Conditional Prohibition For Safeguard Measures. Facilities for rapid clearance. Hotel Armada Petaling Jaya.

See more details in the Customs section below. Malaysian Customs Form 1 Letter of Authorisation Origin Invoice. Service Tax No2 Service Tax License 8.

K2 Declaration of goods to be exported. Customs Form No 2. Be sure to include all necessary information on your commercial invoice since this is how customs authorities will classify and.

Free Industrial Zones and Free Commercial Zones. Service Tax No3 Service Tax Return. However the amount of duty rates charged in advance by different movers vary.

Below is how the customs clearance process works step by step. Customer information and advice service regarding imports and exports in Malaysia. This ATR topic intends to provide information on trade-related procedural and documentary requirements that are imposed in each ASEAN Member State in connection with the importation and exportation of goods.

The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. Customs Prohibition On Import Order 2008 Third Schedule. Getting the required documents in advance is vital if you want to avoid hold-ups at the border.

These documents must be accurate and complete specifically the shipping label and commercial invoice. In the import procedure any goods imported or any goods that are brought from other countries according to the regulation must be written on the customer form. Insurance certificate if insured.

Export Documents In case of red line high risk shipment the minimum documents required to be submitted to the Customs for the clearance of export consists of. K3 Application Permit to transport goods from Peninsular Malaysia to East Malaysia or vice versa. Vision Mission.

Sales Tax No3 Sales Tax Return CJP 1 9. Goods Arrive At Destination Port. Procedure of Customs clearance in Malaysia.

Refund Drawback procedures on duties tax paid. Bill of lading airway bill. In many cases the average duty rate is around 6.

Customs Prohibition on Import Order 2008 Fourth Schedule. Customs prohibitions of imports order 2012- PUA 4902012 Customs prohibition of exports order 2013 PUA 4912012. Export tariffs and taxes.

Malaysia customs apply a tariff on exported goods between 0 to 10 percent following ad valorem rates. The following documents are required by Malaysian customs for exporting products to Malaysia. Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry.

Our team is always ready to meet your supply chain needs. Customs Form No 3. In four steps heres what happens when a shipment arrives at customs.

The Royal Malaysian Customs Department abbreviated RMC or JKDM is the government agency responsible for administrating the nations indirect tax policy customs border enforcement and narcotic offences. In Malaysia the import duty rates can range from as low as 0 to as much as 50. Egg in the shells.

Includes import documentation and other requirements for both the US. Used household goods duty-free if- Customer has owned goods for a minimum of three months and. Quality Declaration of Customs Declaration Forms K1 - K13 and JKDM Form I - IV.

Temporary Import Temporary Export. 14112022 - 15112022 Venue. Under Malaysias Customs Act 1976 tariffs paid on exported goods which were originally sourced from imports are eligible for a 90 percent refund.

Sales Tax No2 Sales Tax License 7. If leaving or arriving from one Malaysia state to another Sabah Sarawak or the Malay peninsula ensure to both clear in and out with all the above offices. The commercial invoice is most important because it lists the contact information for the shipper the receiver as.

A customs officer examines your customs paperwork. Imports by Sea Air and Land. Filing Bill Of Entry BOE Step 3.

Exporter and foreign importer. The Ministry of International Trade and Industry MITI as the Ministry responsible for trade facilitation in Malaysia has set up the National Single Window Business Process Reengineering NSW BPR Working Group that is responsible to formulate and recommend re-engineering of import and export processes. Johann customs clearance team offers efficiency security cost-effectiveness and simplicity when it comes to your international shipments.

Any special docs like FORM E For more details on Customs Clearance please contact us via WhatsApp. Understanding Malaysian Customs Procedures and Documentation Training Date. Customs Procedure for Moving Household Goods into Malaysia All shipments subject to 100 Customs examination.

Customs No13 Warehouse License JKED No3 5. Request a quote here for your Forwarding and Customs Clearance.

Custom Clearance Process The Step By Step Guide Bansar China

Import Customs Procedures In Malaysia

Import Custom Clearance Process Customs Clearance Custom Imports

Explaining Customs Clearance In 4 Easy Steps Easyship Blog

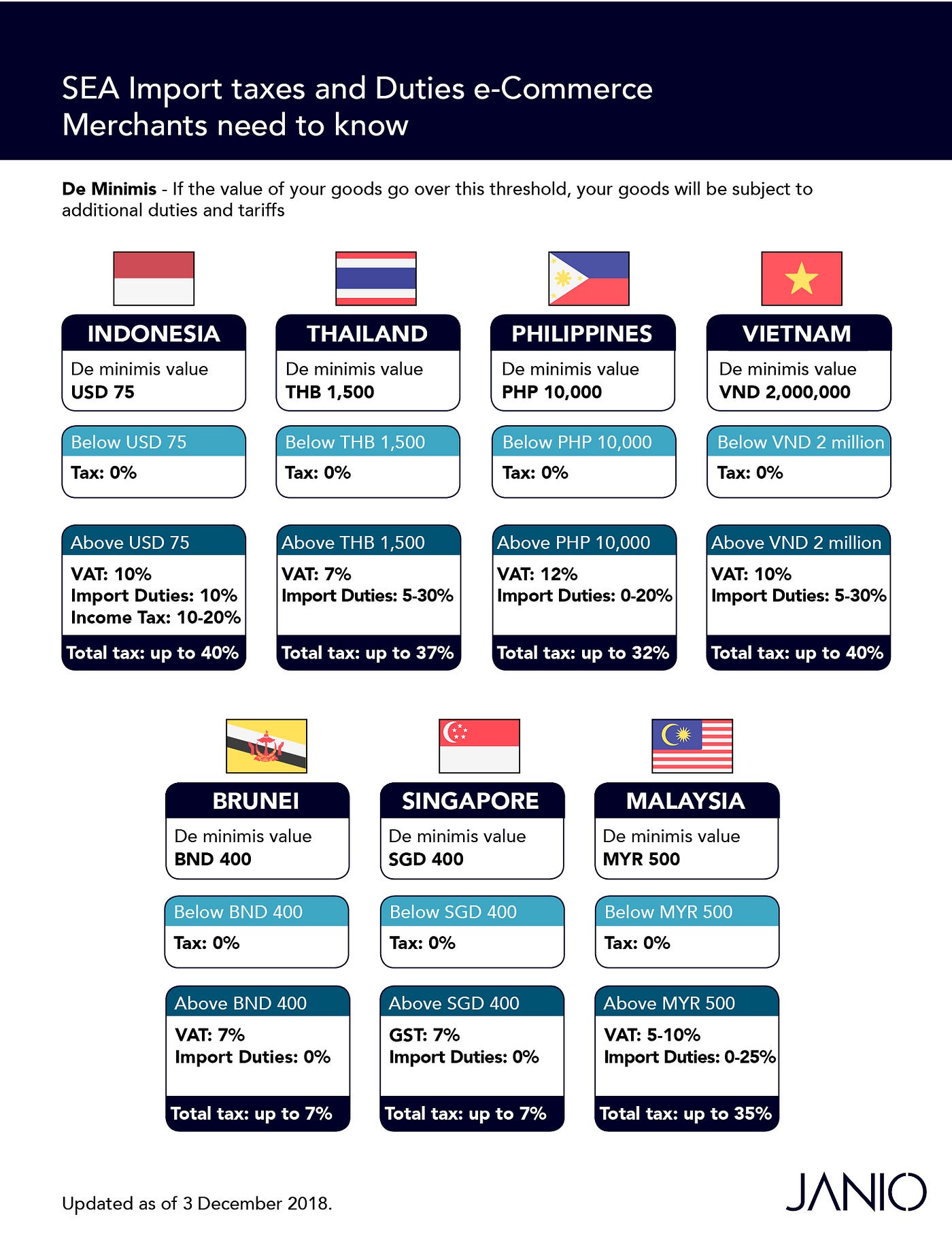

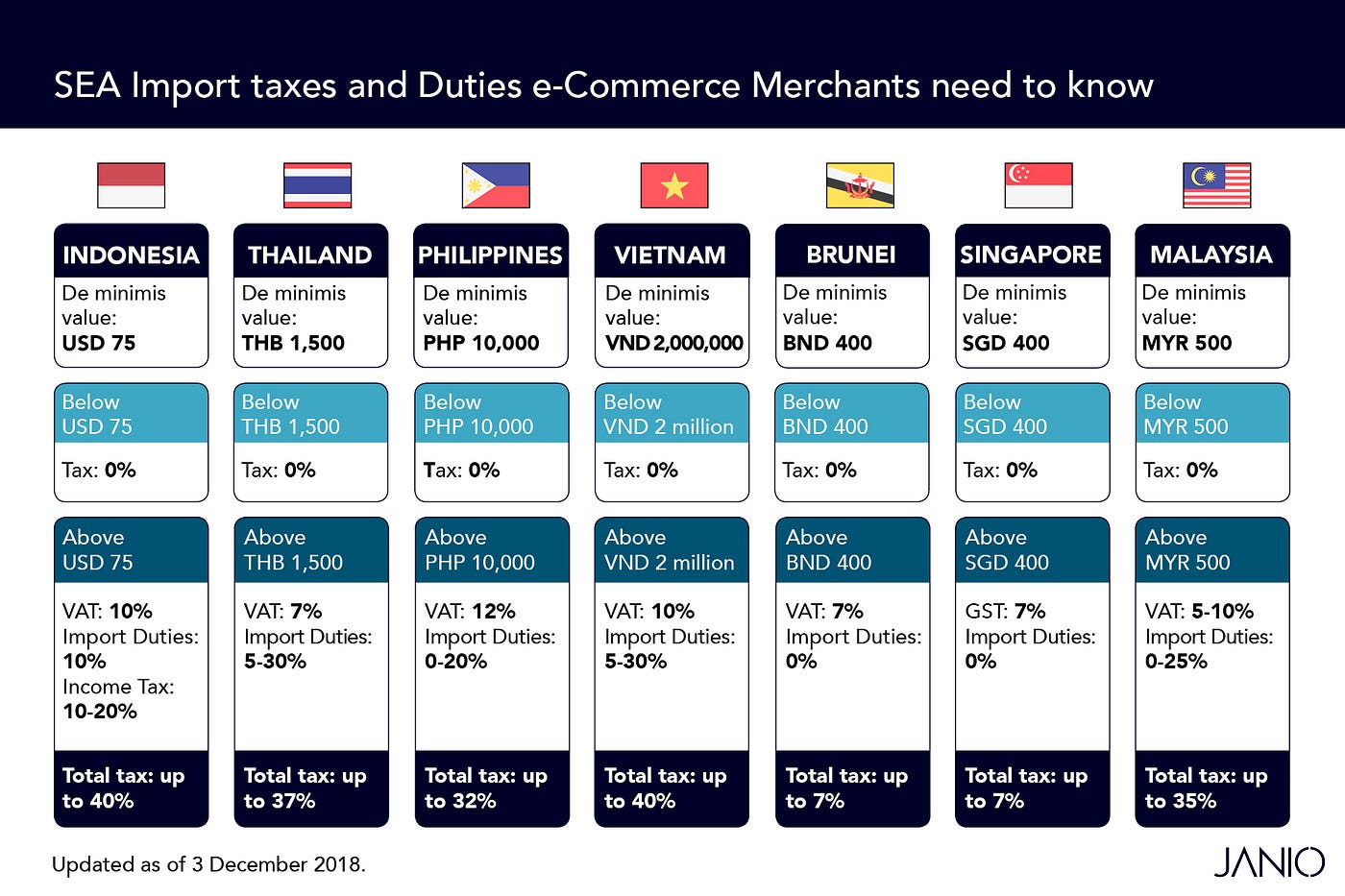

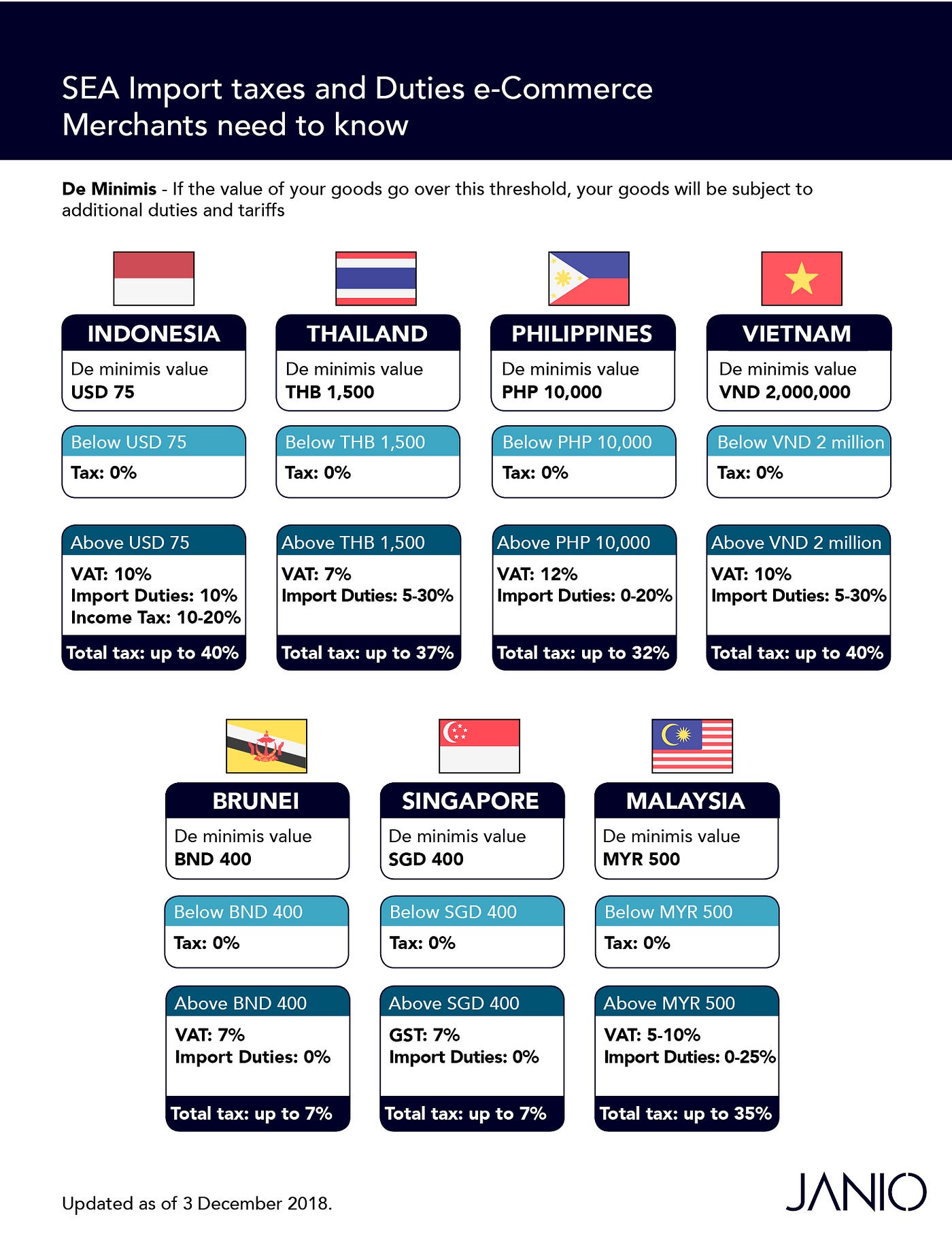

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium

Customs Clearance The Ocean Freight Must Knows Dhl Global Forwarding Malaysia

Custom Clearing Process For Export Ppt Powerpoint Presentation Professional Outline Pdf Powerpoint Templates

An Updated Shipper S Guide For China Customs Clearance

Ocean Care Forwarders Pvt Ltd Ocean Airfreight Freight Forwarder

Shipping Documents Required For Import And Export Customs Clearance

Incidental Shipping Charges Part I Freight And Customs Related Extra Costs

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium

.jpg)

Customs Clearance The Essential Guide To Smooth Cross Border Trade

Iinternational Freight Forwarder Custom Clearance Visit Http Gpliquidations Com By Gpliquidations Com Freight Forwarder Airfreight Custom

Import Custom Clearance Service Custom House Agent Air Cargo Clearance Service Customs Brokerage Service Sea Customs Clearance In House Custom Clearance In Ghatkopar East Mumbai Zale Shipping Logistics Services Private Limited

Customs Clearance In Malaysia Duties Taxes Exemption

How Does Customs Clearance Work For B2c Fulfilment Janio

.jpg)

Customs Clearance The Essential Guide To Smooth Cross Border Trade

Customs Clearance The Ocean Freight Must Knows Dhl Global Forwarding Malaysia